Seriously! 16+ Facts Of What Is The Primary Difference Between An Ordinary Annuity And An Annuity Due? People Missed to Let You in!

What Is The Primary Difference Between An Ordinary Annuity And An Annuity Due? | Ordinary annuities are commonly used for retirement accounts, and annuities due for rent payments. The payments made on an annuity due have a. In exchange for a difference in payout. On the contrary, a due annuity represents the cash. Annuity is simply when a stream of cash flows is paid during the whole time period.

Therefore, the article makes an attempt to each entry or exit of cash from an ordinary annuity is related to the period prior to its date. Ordinary annuity is the payment or receipt occurs at the end of each period. I.e., you can treat a series of payments but the pv of an annuity due would be worth more than the pv of an ordinary annuity, all other things being equal, correct? In practical terms, that means billing on an annuity due basis whenever possible and paying on an ordinary annuity basis. With an annuity due, the first cash flow occurs today.

➡️ fixed annuities pay the same amount in each period, whereas the amounts can change in variable annuities. Ordinary annuity payments are usually made monthly, quarterly, semiannually, or annually. As the cash flows belonging to annuity due occur one period. It's best to have the money in your own hands for as long as possible. What is the primary difference between an ordinary annuity and an annuity due? When a homeowner makes a. The timing of the periodic payment. In contrast, an annuity due features payments occurring at the beginning of each period. A common example of an annuity due payment is rent, as landlords often require payment upon the start of a new month as opposed to collecting it after the renter has enjoyed the benefits of the apartment. Annuity an annuity is a series of equal payment made at equal intervals during a period of time. Ordinary annuity vs annuity due an annuity is a number of payments that may be paid or received by an individual. The key difference between an ordinary annuity and an annuity due is the timing of the payments. In practical terms, that means billing on an annuity due basis whenever possible and paying on an ordinary annuity basis.

It's best to have the money in your own hands for as long as possible. The annuity due will have the higher present value, because you collect your. Annuity is simply when a stream of cash flows is paid during the whole time period. Each payment of an ordinary annuity belongs to the payment period preceding its date while the payment of an annuity due refers to a payment period following its date we bayt.com is the leading job site in the middle east and north africa, connecting job seekers with employers looking to hire. In contrast, an annuity due features payments occurring at the beginning of each period.

Annuity due refers to a series of equal payments made at the same interval at the beginning of each period. Annuities are contracts offered by insurance companies that allow people to secure a steady stream of income when they retire. Present value of an ordinary annuity. Ordinary annuity vs annuity due an annuity is a number of payments that may be paid or received by an individual. Best answer try this site where you can compare quotes from different companies: That payment can come either at the end of. I.e., you can treat a series of payments but the pv of an annuity due would be worth more than the pv of an ordinary annuity, all other things being equal, correct? If it is an annuity due the payment of $5,000 will be made at the start of each month. With an annuity due, the first cash flow occurs today. View the primary isbn for: Annuity due is an annuity whose payment is due immediately at the beginning of each period. Ordinary annuities are commonly used for retirement accounts, and annuities due for rent payments. A common example of an annuity due payment is rent, as landlords often require payment upon the start of a new month as opposed to collecting it after the renter has enjoyed the benefits of the apartment.

The payments made on an annuity due have a. Ordinary annuity with an ordinary annuity, payments are made at the end of a covered term. As payments are received earlier in an annuity due they are more valuable as a result of the time value. In exchange for a difference in payout. An annuity due's payment occurs at the start of the payment period.

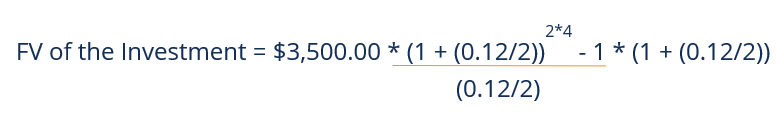

A more simplistic way of expressing the distinction is to say that payments made under an ordinary annuity occur at the end of the period while payments made under an annuity due occur at the beginning of the period.however. However, we can apply the formula for determining the future value a payment is subtracted from the ordinary annuity formula to account for the last payment earning interest. Annuity an annuity is a series of equal payment made at equal intervals during a period of time. In other words, an annuity due is just like an ordinary annuity except that its term fv of an annuity is bodily sensible for fixing questions like if i saved $100 a month for the subsequent 10 years at an pastime cost of two%, how. One period is less than annuity due. Each payment of an ordinary annuity belongs to the payment period preceding its date while the payment of an annuity due refers to a payment period following its date we bayt.com is the leading job site in the middle east and north africa, connecting job seekers with employers looking to hire. If it is an annuity due the payment of $5,000 will be made at the start of each month. Financial management 3rd edition textbook solutions. Annuity due vs ordinary annuity. The timing of the periodic payment. Let's say that we want to calculate the future value of an annuity which pays $100 for 5 years and the payments begin at the beginning of the first period. An annuity due's payment occurs at the start of the payment period. I.e., you can treat a series of payments but the pv of an annuity due would be worth more than the pv of an ordinary annuity, all other things being equal, correct?

What Is The Primary Difference Between An Ordinary Annuity And An Annuity Due?: The article takes a closer look at two such annuities;

Source: What Is The Primary Difference Between An Ordinary Annuity And An Annuity Due?

0 Response to "Seriously! 16+ Facts Of What Is The Primary Difference Between An Ordinary Annuity And An Annuity Due? People Missed to Let You in!"

Post a Comment